One half of a profitable app is the app itself – you obviously need a solution that people will pay for.

The other half is deciding how people pay.

Let’s say you want to go with a subscription-based app revenue model – because let’s just agree ads can go to hell.

The million-dollar question: Do you make your profits from high prices or high sales volume?

Can’t have both, so which is the right choice for your solution?

We’ll explore that by looking at three equally successful apps occupying three very different price points: $0.99, $9.99, and $99.

By the end, you’ll have a better idea what kind of price point is best for your app.

Let’s first take a look at what factors affect the choice of app monetization models.

Factors Affecting App Revenue Model

Just some real quick disclaimers:

- The numbers stated mainly refer to Google Play Store stats (Apple download info is private).

- There are many other revenue models out there, this article focuses on subscriptions.

- The revenue figures are based on ZoomInfo, so it won’t be 100% accurate but that’s fine – it’s enough to show the app is successful.

Next, here are four factors that affect the choice of revenue model:

- User Persona

- Market Size

- Barrier to Entry / Competitors

- Price Elasticity

User Persona

Your user persona is a snapshot of your primary customer’s key details – including age range, income bracket and typical personality traits.

To put it bluntly, do they have money, and what do they normally spend it on?

Many founders start with a solution, and that’s fine, as long as it’s ultimately mapped to a real user persona and the right price point.

You can have as many personas as is relevant (taking care not to over-inflate the number of personas).

Be specific and honest, because your user persona(s) is how you estimate the second factor:

Market Size

How many potential customers are out there?

For example, say we wanted to target all pet owners in the US – our market size would be over 85 million.

Now say we wanted to target only German Shepherd owners in the US – our market size has now shrunk all the way down to about 3.5 million.

While bigger markets sound more lucrative, in reality, they’re a lot more competitive.

Unless you can really scale your product to deliver unbeatable prices, smaller markets tend to be better.

Say you wanted to compete with Walmart.

If you had billions of dollars in upfront capital, you could open your own hypermarket and sell exactly what Walmart sells while competing with them on price.

If you don’t, you’d be better off opening a specialty shop with products that Walmart doesn’t want to carry – your market size is smaller, but you have a shot at getting a share of that market.

Note: Just make sure it’s big enough – the last thing you want is to pick a niche that has no money in it!

Barrier to Entry / Competition

Whatever you’re doing, how difficult would it be for someone else to do the same?

Here’s the thing about having a successful business: everyone will want to copy it.

If your product can’t be copied, congratulations; you’re now in a powerful position where you pretty much don’t have to worry about competition.

Take Cyber Tuner for example, it’s an app priced at $999 and offers professional-grade piano tuning services that no typical developer can compete with.

This is a true unicorn in the wild meant to be admired but not emulated.

It’s such an outlier we’re not even including it as an example worth comparing.

Of course, being unique is a huge advantage, but it’s not a blank cheque to charge whatever you want – you still have to consider this very simple economic principle:

Price Elasticity of Demand

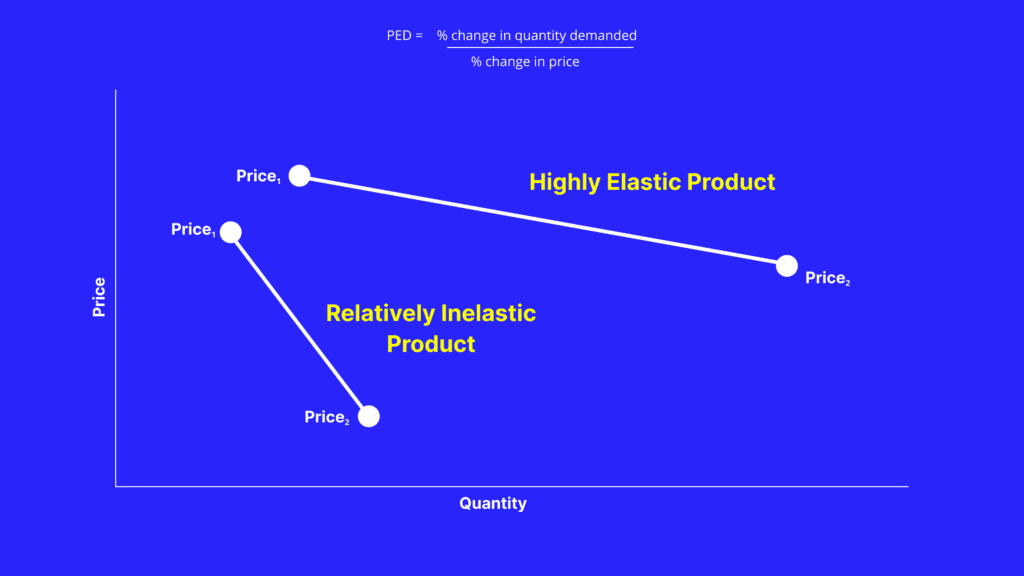

Your app could be really popular at a certain price, let’s call it $10.

And you’re an entrepreneur, so of course you try to make more money by raising the price to $11.

At the new price, demand stays the same – that’s a 10% increase in revenue and it’s all profit.

Hallelujah!

You get greedy – whoops, we meant to say entrepreneurial – and try raising it to $12, causing your demand to drop by half.

You make more per sale, but overall way less revenue.

That’s price elasticity of demand at work.

The higher the elasticity, the more you can increase price without seeing a drop in demand – this mainly applies to essential goods like gas and food.

Let’s just be clear, though: nobody likes price increases.

It’s just that if your app is essential (say, a critical business service provider) you have a lot of leverage over customers.

True story: during the peak of the Covid lockdown in Malaysia, there was a digital HR app – which we won’t name – that basically held customers’ data hostage. Cash-strapped SMEs were told to either pay their subscription fee or have their contract terminated and lose months to years of payroll and compliance data. Because of how essential the data was, customers paid and said HR app is still in operation – in fact, they’re bigger than ever.

On the other hand, it can really backfire if your app is not as essential as you’d hoped, – remember Twitter Blue?

Of course, overall sales figures are what ultimately matter, so founders usually experiment with different price points to see where they maximize revenue.

Let’s just recap the factors that affect app revenue models:

- User Persona

- Market Size

- Barrier to Entry / Competitors

- Price Elasticity

This list is how we’ll be examining our examples, speaking of which, let’s look at our first one:

$0.99 App Revenue Model: Camcard

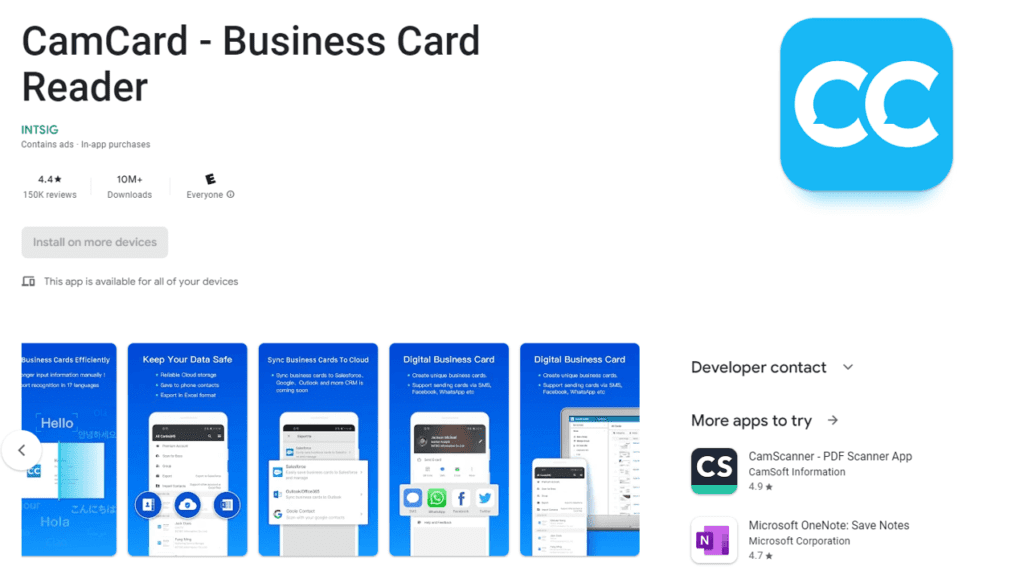

This is CamCard – it costs $0.99, and has 10 million downloads, with a total revenue of $6.6 million.

CamCard lets users store a digital business card inside their phone.

Instead of carrying a bunch of single-use physical cards, with CamCard you just fill in your details on your phone and it gets saved as a shareable QR code that someone can scan.

A basic digital business card is free-to-use, and there’s a premium version where they offer unlimited scans and the ability to export your list of contact information to other platforms like Excel and Salesforce.

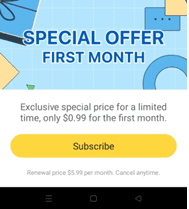

They’ve got a few different pricing options, but what landed them a spot on this list is their $0.99 special deal for a ‘limited time only’.

A few things to note here:

- it’s only $0.99 for the first month and $5.99 every month after

- ain’t no way this is for a ‘limited time only’

It’s not like they’re lying to people’s faces, but there are definitely some marketing strategies at work here based on an understanding of their product and customer base.

Let’s break it down.

User Persona

Everyone who regularly networks and uses business cards – spanning a variety of age ranges, genders, personality traits and income brackets. This means everyone from CEOs of blue-chip companies down to undergraduates in university.

One thing they all have in common: they find physical business cards a chore and would love to have a way to make it more convenient.

Market Size

It’s huge – the market size is easily going to be in the tens, if not hundreds of millions. But it’s important to remember that we’re talking about hundreds of millions of people across varying income brackets.

Barrier to Entry

Really low!

It’s useful, but nothing this app offers is unique or particularly hard to do. There’s no defining feature and we’re not trying to be mean, but it’s kind of like a gas station of apps – they’re all the same, it’s just which is the nearest.

Price Elasticity

The market is huge, the product is easy to build and has a low barrier to entry – indicating the app will have very low price elasticity and you can easily price yourself out of the market.

For that reason, CamCard has chosen a low-price, high-volume app revenue model approach, as well as recurring charges.

When selling to those with less spending power, you’ll have more success with recurring small charges, because that way you stay accessible to all of your users, all of the time.

In the long run, you still end up making a healthy amount of profit.

$9.99 App Revenue Model: RadarScope

This is RadarScope – it costs $9.99 and has 100,000 downloads, with a total revenue of $5 million.

It’s an interesting case – not in our wheelhouse at all, and that’s kind of the point!

We think their official app description does a perfect job of describing what it does, and who it’s addressing:

We understood like 15% of that and have zero interest in finding out the remaining 85%.

We love it though; RadarScope knows exactly who they want to attract.

This description is filled with jargon and doesn’t make any attempt to simplify it – if you know, you know, and if you don’t, it’s not meant for you.

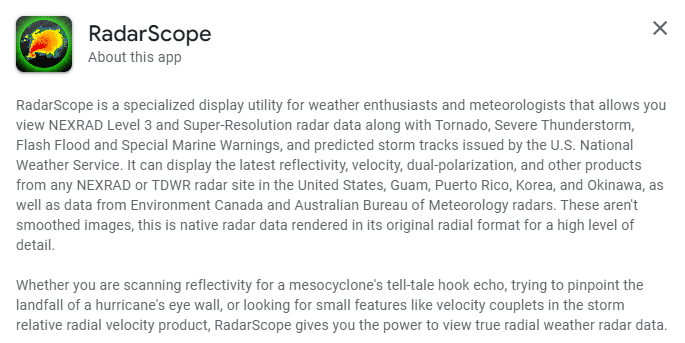

Let’s compare RadarScope’s display to that of a more typical weather app:

Now let’s break it down.

User Persona

As the description states, it’s for meteorologists and weather enthusiasts – we guess that’s a thing?

We also noticed the app specially caters to the North American market – all their displays are for US cities, and we can’t actually download the app on our phones as it’s region-locked.

We honestly don’t have a clue what the average meteorology enthusiast is like.

One thing you learn as you go through life is that people develop passions for anything and everything, and passionate people are great customers.

You just need to make sure there are enough of them.

Market Size

A quick Google Search shows the biggest weather hobbyist group is the American Meteorological Society with 13,000 members.

Just based on that, to a developer like us with no insider information on weather and meteorology, this doesn’t seem like a feasible business idea at $9.99 – the market’s just too small.

Clearly, the developers know better – they’re long-standing industry experts who started the app 12 years ago and have built up a solid reputation.

This is what we meant earlier about finding quality niche markets, and having on-the-ground knowledge of industry trends and true market size is invaluable.

Barrier to Entry

It is insanely high – even if Upstack Studio wanted to build this app, we don’t think we could, and neither could most other developers.

Not only is there a high knowledge requirement, you’d also need lots of integration with potentially sensitive satellite data and that kind of stuff doesn’t just get handed over.

Price Elasticity

The biggest factor working against this app is that it seems relatively non-essential. It may be great at what it does but it ultimately feels like a hobbyist’s toy, which can easily price itself out of the market.

We wouldn’t be surprised if people who used this also had a simpler weather app.

As a result, RadarScope’s revenue model for the mobile app is a one-time $9.99 subscription.

Because the market is smaller and there’s a really high barrier to entry, they have a unique product and a passionate audience – they just need to find the right price point, and in this case, it’s a $9.99 one-time payment to download.

At 100,000 downloads, this gives them $1 million in revenue from their Google Play Store alone.

Overall, ZoomInfo has them making $5 million in revenue.

$99 App Revenue Model: Crestron App

This is Crestron App – it costs $99 and has 50,000 downloads, with a total revenue of $4.95 million.

To fully understand Crestron App’s revenue model, we need to look at their parent company.

Crestron Electronics is an American MNC that makes and sells high-end audiovisual automation and integration equipment. So all the expensive TVs, speakers, and sound systems you see in commercial outlets and luxury homes.

How expensive? Let’s just say a lot of the products on their site don’t have prices displayed.

For reference, Crestron made $2 billion in 2021.

The Crestron App was an IoT app that turned an Android phone into a remote control for basically every appliance in the home.

Users could control lighting, music, heating & cooling, security, televisions, shades, door locks, and CCTVs all from one interface. Wow!

It all comes down to understanding your user and your product, then nailing the revenue model.

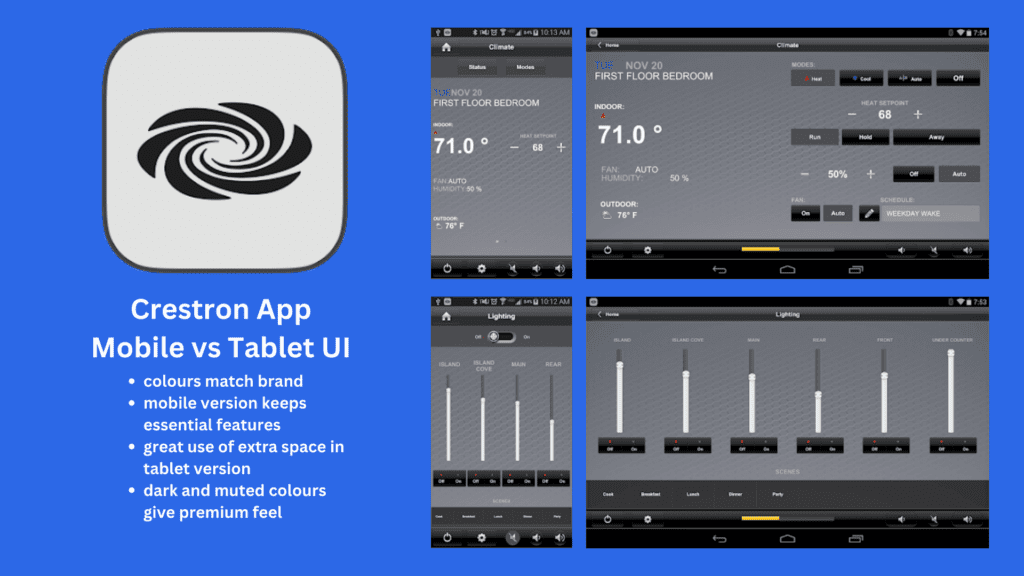

The interfaces themselves look very nice and intuitive. It’s tablet-friendly and easily navigable by everyone from young children to the elderly.

The Crestron App’s revenue model is simple – $99 for a lifetime subscription.

Breakdown time!

User Persona

People who can afford to have an integrated office or home media system worth tens to hundreds of thousands of dollars. These personas want the luxury experience, and they have the disposable income to pay for it.

Market Size

It’s small because most consumers will simply not be able to afford this sort of luxury, and this is clearly an attempt by Crestron to upsell their hardware.

Barrier to Entry

Really high!

Yes, you could make your own IoT app to compete with Crestron, but even if it worked better, people always prefer going with the original manufacturer – so yeah, their customers are never leaving them.

Price Elasticity

When you drop fifty thousand dollars on a home system, the ability to connect and control everything through a phone becomes sort of essential to get the full experience. We’d say it’s got decent elasticity – Crestron could have gotten away with a higher price point.

So, with a user persona of wealthy consumers, a relatively small market size, a high barrier to entry, and decent price elasticity, it makes sense to go for a high-price, low-volume app revenue model.

It’s not that they want low volume, it’s just that they’re realistic about their market size.

We see on Google Play Store that they got 50K downloads (and why would anyone download it if they weren’t going to use it) bringing the total revenue to just under $5 million.

Which App Revenue Model is Right for You?

As mentioned at the start, your app subscription revenue can come from either high sales volume or high prices.

Understand your user persona, market size, barrier to entry and price elasticity, and that should give you a good idea of which to go for.

And hey, it might turn out that your app works better with an entirely different model (such as an in-app advertising revenue model).

Just remember that at any price, when people pay, there is an expectation of quality – you need to demonstrate your worth.

If you don’t have a working product that delivers on its promises, no revenue model in the world will save your business.

For that reason, it’s crucial to deliver a good user experience continuously.

Now go make some money!

By the way: Like what you just read? Then read some more! Sign up for our newsletter and get concise and actionable content on mobile app development sent directly to your inbox. Plus, get a snazzy little list of questions to interview app developers and find the right one for you.

Download this template now so you know exactly what to ask App Development Agencies! Let us know where should we send it through the form below.