Not All App Fundraising Methods Created Equal

As far as we can tell, there are eight distinct ways to raise funds to develop an app or SaaS:

- Bootstrapping

- Venture Capital

- Angel Investment

- Friends & Family

- Crowdfunding

- Incubators and Accelerators

- Grants

- Bank Loans

And they’re not all equal – some are great, some good, and some downright stink!

We’ve ranked each of them according to great, good, and terrible fundraising methods.

Of course, this list is strongly influcenced by our personal opinions, and at the end of the day, money is money, so if that’s what it takes, that’s what it takes!

Let’s begin.

Great App Fundraising Methods for App Development

1. Bootstrapping

This means funding an app with personal savings or revenue currently generated by the app or any other personal income streams like an existing business.

Advantages of Bootstrapping:

- Full Control: You own your business and make key decisions.

- Safe to Fail: Provided you know your limits, you know how to safely fail.

- Focus on ROI: You only spend with proof of returns – no blind gambles.

Disadvantages of Bootstrapping:

- Limited Resources: If your app needs to scale, savings and early profits won’t be enough unless you’re loaded (in which case why are you reading this?).

- Slower Growth: You grow at a snail’s pace compared to a VC backed business.

Our Thoughts

Frankly, we think most apps don’t need to grow that fast.

In fact, most apps would benefit more from slower but calculated growth instead of explosive diarrhea all over the place and it lands all over the floor instead of the toilet bowl.

Most businesses are fine with bootstrapping – so we’re gonna put it in A tier.

2. Venture Capital

This is when a company known as a venture capital firm invests large amounts of capital in exchange for equity in your app development project.

And we’re talking huge sums – leading Venture Capital (VC) firms like Sequoia Capital manage close to USD 80 billion worth of assets.

Advantages of Venture Capital:

- Large Capital Injection: If you need to scale your project, venture capitals will give you the money you need.

- Exit Strategy: VCs invest when they see signs a business can eventually be sold off for ten to a hundred times the initial investment.

- Validation Domino Effect: Getting VC funding is a sign your business is unique, attracting even more investors and big ticket customers.

Disadvantages of Venture Capital:

- Equity Dilution: Remember VCs want to sell your business for 10X what they invested. They do this by raising investment in several rounds where your equity is diluted.

- Loss of Control: The VC gets a say in company decisions and always chooses money.

- Pressure for Growth: Extremely stressful and may compromise your product.

Our Thoughts

We don’t think most apps need to grow so fast that it’s worth taking VC funding.

But if you really want to build the next Reddit or Uber or OpenAI, Venture Capital specialize in growing and scaling and it’s a perfect match.

In those cases, nothing really comes close to the financial support a VC firm offers.

3. Incubators and Accelerators

An Incubator or Accelerator is like a VC on steroids.

It’s like a VC in that it gives you lots of funding, but offers a ton of support on top of that.

Advantages of Incubator and Accelerators:

- Support and Mentorship: You can speak to experts, mentors, and a whole community.

- Success Blueprint: There’s a step by step plan to take you from zero to hero, if you listen.

- Resources: You get office space, funding, and legal, business, and tech support.

- Networking Opportunities: You get introduced to investors, partners, and potential customers.

Disadvantages:

- Equity Exchange: Duh.

- Fixed Program Length: Those blueprints are often rigid and won’t apply to every business.

- Selective Admission: Getting into an incubator is like qualifying for the Olympics.

Our Thoughts

As much as we love bootstrapping, if we could get into an incubator, we’d jump in with both feet, blindfolded, and our hands tied behind our back.

Our founder Adrian had a small taste of what it’s like when he visited Google’s startup incubator in Korea.

According to him, it was heaven on Earth.

Good App Fundraising Methods for App Development

1. Angel Investment

This is early-stage funding from a wealthy person.

Like a VC, an angel investment take a chunk of equity, but come in pre-revenue, while VCs usually need to see proof your business is already making money

An angel also has less capital than a VC firm, and in general we think of them as a diet VC.

Advantages of Angel Investment:

- Mentorship: A lot of angels were once in your shoes and can give valuable mentorship.

- Pre-Revenue Investment: This is the big one – it’s rare for VCs to invest pre revenue.

Disadvantages:

- Limited Capital: Angels have less to invest compared to a VC, so you may give up equity without getting enough capital to fully fund your growth.

Our Thoughts

In terms ofd raising funds for app development, we’ve put angels as good but not great because while they have their place, they’re in a kind of weird middle ground between bootstrapping and VC funding

Generally, we’d much rather bootstrap to profitability and if needed, go for a Venture Capital or an incubator.

2. Grants

A grant is free money to fund for your app development or business – even if it fails, you don’t have to pay it back.

Just don’t use it to buy a new sports car or you’ll end up in jail.

Governments and even VC firms often have grant programs if you search.

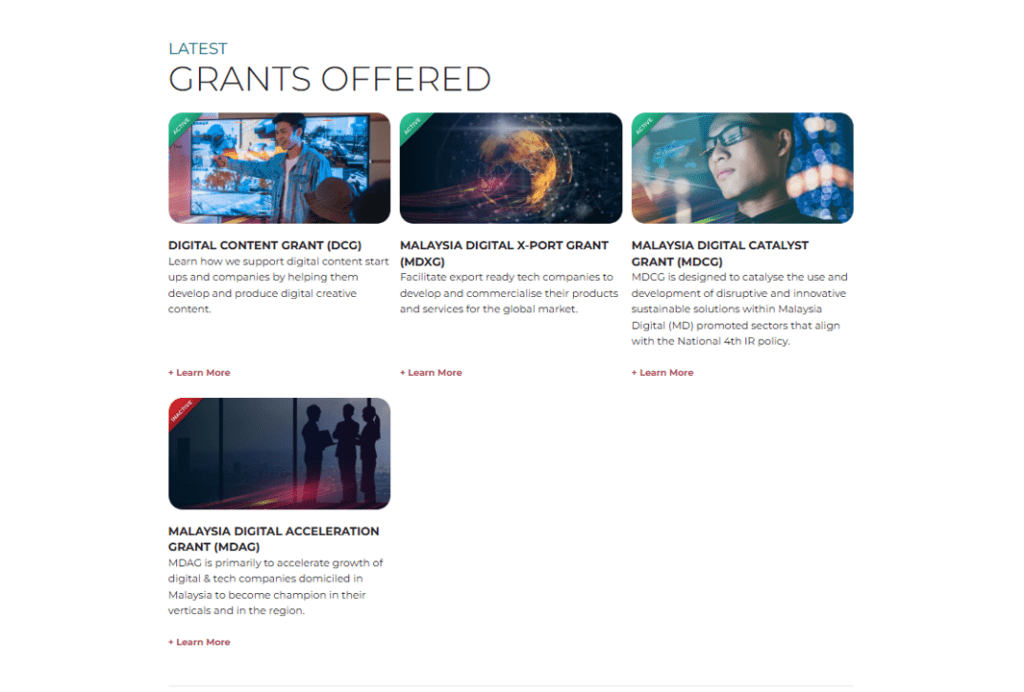

This is an example from the Malaysian Digital Economy Corporation, our country’s government agency whose purpose is to ‘drive the digital economy through catalytic high-impact initiatives, strategic and sustainable investments, and inclusive policies.’

Translation: We give you money, you give us tech.

They’ve got all these different grants and a list of recipients.

Your government will almost certainly have some too.

Advantages: of Grants

- You Keep Full Equity: You normally don’t give up any equity or repay the grant – it’s literally free money.

- Recognition: Winning a grant boosts your credibility and help attract more investors.

Disadvantages of Grants:

- Competitive: Grants are VERY competitive – even more so than incubator spots.

- Strict Reporting Requirements Grants recipients usually need to prepare reports on their progress and how they’ve used the funds so far

Our Thoughts

So it’s not completely free money, but it’s a really small price to pay.

We’ve ranked grants as good but not great for app development funding because despite how awesome they sound in theory, in practice a lot of grants have very narrow scopes and if it’s a government grant, decision makers are often not the most informed or technically savvy.

As a result, projects are quite likely to get funding because of favoritism.

Decent App Fundraising Methods

1. Crowdfunding

This is where you raise small amounts of money from the public through an online campaign.

We see it all the time on platforms like Kickstarter and indiegogo.

You describe your project, explain how much you need, why you need it, and by when, and you let the market decide.

Advantages of Crowdfunding:

- Market Validation: Raising funds from users is the best form of app idea validation.

- No Debt: You’re not using your own money or taking on debt nor giving away equity.

- Market Exposure: Crowdfunding campaigns are a great marketing tool for visibility.

Disadvantages of Crowdfunding:

- Public Disclosure: You publicly share details about your app which can be copied if it gains traction.

Our Thoughts

We could go on kickstarter right now and search for app campaigns that have been 100% funded and we’ll know what idea we can steal.

To us that’s a lot of risk, so we have a feeling we’re gonna disagree on this one.

That’s why we’d rank crowdfunding only as a decent method – definitely not our first choice.

2. Bank Loans

Do I really need to explain what a bank loan is?

We will say that unlike a grant, you can use a bank loan to buy a sports car instead of funding your business.

Enjoy it for a few months then cry when they tow it away, along with your house and your hopes and dreams 🙂

Advantages of Bank Loans:

- Full Equity: The bank doesn’t want a stake in your startup.

- Full Decision Making: Banks just care that you pay them on time every month

Disadvantages of Bank Loans:

- Debt: Loans come with interest, which sucks if the business doesn’t meet projections.

- Collateral Requirement: Many banks will need you to put your house up as a guarantee which means you could literally end up homeless

- Strict Eligibility: Banks won’t lend to you without proof you can repay.

Our Thoughts

You know what, those strict eligibility thing is an advantage, cause student loans where banks let students put themselves in life crushing debt is borderline criminal.

Still, we’d rank bank loans as a decent app fundraising method.

It’s not out of the question, but is inferior considering other available options.

In fact, it would probably be the last option we’d personally consider before turning to the last fundraising option, and sole entry under ‘terrible’.

Terrible App Fundraising Methods

Friends & Family

We’re not even gonna bother listing out the pros and cons of this one.

We said at the start that money is still money.

And we stand by it – you can ask friends and family to invest.

But consider the risk to reward profile

- if you succeed, you make more money.

- If you fail, you lose money and your loved ones.

And to us personally, that risk to reward ratio is not worth it.

Happy fundraising!

Hey there stranger, thanks for reading all the way to the end. Consider joining our mailing list for a one-stop resource on everything from micro SaaS validation all the way to execution and promotion. Get a nifty list of questions to ask app developers when you sign up!

Download this template now so you know exactly what to ask App Development Agencies! Let us know where should we send it through the form below.