Malaysia: The Forefront of Mobile Wallet Adoption

The Adyen Index 2024 reported that 63% of Malaysians use mobile wallets for transactions.

The index, which surveyed over 38,000 shoppers and 13,000 merchants across 26 markets, places Malaysia at the top of global mobile wallet adoption.

Additionally, recent data from Vodus’ survey indicates that 52% of Malaysians use e-wallets for online shopping, and 48% for online food delivery, reflecting a shift towards digital payments.

The trend towards cashless transactions is reshaping financial behaviors, with 41% of Malaysians now relying on mobile-enabled solutions like tap-to-pay. This surge in digital payment adoption is driven by the demand for convenience, with Malaysian consumers favoring quick and seamless payment methods.

Growth of Mobile Payment Apps: 2022 vs 2023

In 2022, over half of the Malaysian population used cashless payments daily, a trend accelerated by the COVID-19 pandemic.

By 2023, e-wallet usage peaked, nearing the high of 64% overall usage recorded in 2021.

Despite a slight reduction in the number of e-wallets used per individual—from an average of 2-5 to 1.9—the integration of e-wallets with more services made it easier for users to rely on a single e-wallet for most payment needs.

The average monthly e-wallet spend in 2023 was RM245.28, the lowest in the past three years.

While that may sound like bad news, it’s quite the opposite!

The increased adoption rate combined with lower average spend suggests two things:

- Usage is increasing across socioeconomic brackets.

- E-wallets are not being treated like credit cards which are reserved for big ticket items, but as a genuine replacement for cash.

Both of these are strong signs of maturation in e-wallet adoption and usage.

However, it should be noted that cash is still the preferred payment method among Malaysian consumers at 41%, followed by debit cards (18%) and e-wallets (14%).

Leading Mobile Payment Apps in Malaysia

Among the many e-wallet options in Malaysia, several apps have emerged as leaders:

- Touch ‘n Go eWallet: Dominates with a 62% preference among Malaysian consumers, largely due to its extensive acceptance in public transport and retail sectors. The majority of its users are males aged 25-34, primarily of Chinese ethnicity, with an income range between RM3,000 to RM10,000.

- GrabPay: Known for its integration with Grab’s services, making it a popular choice for ride-hailing and food delivery.

- Boost: Offers diverse financial services, including insurance and investments.

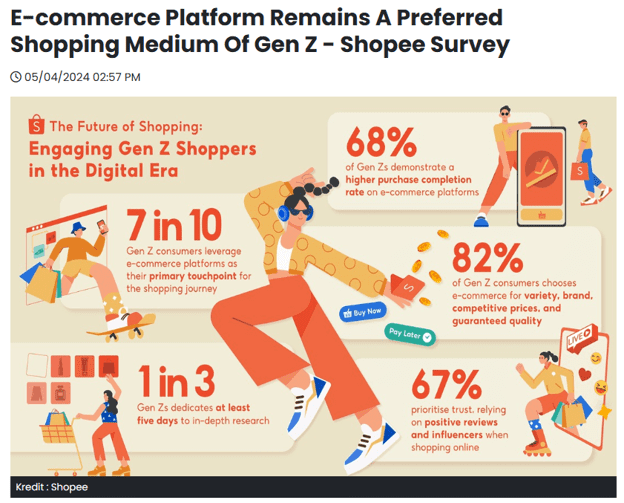

- ShopeePay: Gaining traction particularly among younger users aged 18-24 and those with lower income brackets.

User Demographics and Preferences

E-wallet adoption spans various age groups, with millennials and Gen Z leading the charge.

Millennials are notably active on social media, with 80% having shopped on them in the past year.

Preferences vary by age and income, with older users and higher-income groups leaning towards apps developed by banking institutions, while younger and lower-income users favor apps like ShopeePay.

Adoption Rates and Transaction Volumes

E-wallet adoption in Malaysia has reached 63% of the population, with transaction volumes rising significantly. E-wallets are particularly preferred for:

- online shopping (52%)

- food delivery (48%)

However, cash remains prevalent for certain transactions, such as petrol (34%) and EV charging (34%), and debit cards are favored for hotel payments.

Key Drivers of Mobile Payment Adoption

The key factors driving the widespread use of e-wallets include:

- Convenience: The ease of using smartphones for payments is a major appeal.

- Security: Enhanced security features, though concerns persist, as only 66% of Malaysians feel secure using e-wallets.

- Incentives: Offers like cashback and rewards attract users.

- Integration: E-wallets’ ability to integrate with various services enhances their appeal.

Future Trends and Projections

The future of mobile payments in Malaysia appears promising, with several trends on the horizon:

- Increased Integration with IoT: E-wallets are expected to expand their functionality with smart devices.

- Enhanced AI and Personalization: AI will drive more personalized financial management options.

- Regulatory Developments: New regulations may influence the market, focusing on consumer protection and financial inclusion.

Conclusion

With the majority of Malaysians embracing cashless transactions and the rapid integration of e-wallets with various services, businesses must adapt to these changes to stay competitive.

Addressing app security concerns and enhancing the convenience of e-wallets as part of building a robust digital marketplace will be crucial for growth and customer loyalty.

Good luck!

🔑 Key Takeaways

- A report as far back as 2017 by Fintech News Malaysia found there were over 53 e-wallets in Malaysia.

- E-wallet in Malaysia has gained remarkable traction, with 63% of Malaysians adopting mobile wallets for transactions.

- The list of e-wallets in Malaysia includes popular platforms such as Touch ‘n Go eWallet, GrabPay, Boost, and ShopeePay.

- As of 2024, the Malaysia mobile wallet is mainly driven by online shopping (52%) and food delivery (48%).

- The ongoing rivalry between Boost vs TNG reflects the competitive nature of the Malaysia payment app market.

- BigPay eWallet is most popular among younger consumers.

- Users appreciate e-wallets with physical cards such as Touch n Go.

Hey there stranger, thanks for reading all the way to the end. Consider joining our mailing list for a one-stop resource on everything from micro SaaS validation all the way to execution and promotion. Get a nifty list of questions to ask app developers when you sign up!

App Developer Interview Questions Template

Download this template now so you know exactly what to ask App Development Agencies! Let us know where should we send it through the form below.